Telling Your Money Where To Go: How to Budget

I recently wrote about how you can save thousands of dollars a year.How you manage your money is important. Because either you manage it, or it manages you. And debt not only causes stress and can strain on a marriage, it also prohibits us from living a generous life that Christ calls us to live.The reality is, making more money will not make you more generous. In fact, statistics show that the more money you make, the less amount you give. In 1933 at the height of the great depression, per-member giving in churches was at 3.3%. Today its at 2.5%.We are much more affluent now compared to then, and we are less generous with what we have.When it comes to making a budget, where to you even begin? Now I'm not a financial expert, but I can share how Christina and I organize ours. But it is important to remember that it will take a few months of estimating what each line item should be.So my recommendation is to pick a number as best you can, and adjust it accordingly. Budgeting does take a little more work as you figure it out the first few months, but once you are up and running, it takes less than a minute at the end of the day to update what you spent.Practically you can use a simple program like Microsoft Excel. My wife and I use Google Sheets (which works the same way). The benefit of Google Sheets is that you can view and update it anywhere through your Google account, so you can access it on any computer and on your phone.Here is a screenshot of the line items in our current budget. We have added some and taken some away as life changes, but many of these line items carry over to most people. Click on the image to see it enlarged.

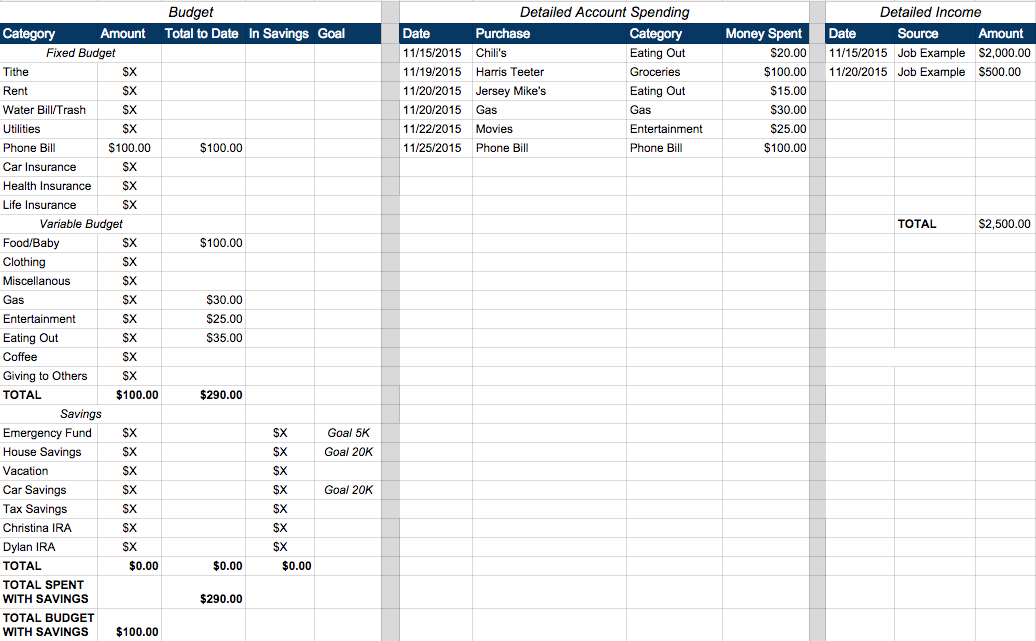

I recently wrote about how you can save thousands of dollars a year.How you manage your money is important. Because either you manage it, or it manages you. And debt not only causes stress and can strain on a marriage, it also prohibits us from living a generous life that Christ calls us to live.The reality is, making more money will not make you more generous. In fact, statistics show that the more money you make, the less amount you give. In 1933 at the height of the great depression, per-member giving in churches was at 3.3%. Today its at 2.5%.We are much more affluent now compared to then, and we are less generous with what we have.When it comes to making a budget, where to you even begin? Now I'm not a financial expert, but I can share how Christina and I organize ours. But it is important to remember that it will take a few months of estimating what each line item should be.So my recommendation is to pick a number as best you can, and adjust it accordingly. Budgeting does take a little more work as you figure it out the first few months, but once you are up and running, it takes less than a minute at the end of the day to update what you spent.Practically you can use a simple program like Microsoft Excel. My wife and I use Google Sheets (which works the same way). The benefit of Google Sheets is that you can view and update it anywhere through your Google account, so you can access it on any computer and on your phone.Here is a screenshot of the line items in our current budget. We have added some and taken some away as life changes, but many of these line items carry over to most people. Click on the image to see it enlarged. The "Fixed Budget" are things that we know will cost the same every single month. The "Variable Budget" are things that vary. The goal is to not go over on any of the variable budget line items, but these are not concrete expenses so that can fluctuate a little.You will also notice our middle column Detailed Account Spending. This is where we track everything we spend. If we spend $20 at Chili's, then we put Chili's under "Purchase," "Eating Out" under "Category," and "$20" under "amount spent."This way if there is a discrepancy in how much we have spent in "Total to Date," we can look at our "Detailed Account Spending" to make sure everything matches up. You aren't budgeting if you aren't tracking every penny you spend. And if you don't tell your money where to go, it just goes.I added a couple of examples so you can see how it works. Notice how there are two instances of "Eating Out," and the "Total to Date" reflects both of those purchases. You can also see how the phone bill is a fixed number.The truth is, having a budget means having to say no to certain things, and that isn't always fun. But not having to worry when you have car trouble, or having the savings to go on a vacation is more than worth the trouble.All of this, goes back to what Jesus said in Matthew 6:24.

The "Fixed Budget" are things that we know will cost the same every single month. The "Variable Budget" are things that vary. The goal is to not go over on any of the variable budget line items, but these are not concrete expenses so that can fluctuate a little.You will also notice our middle column Detailed Account Spending. This is where we track everything we spend. If we spend $20 at Chili's, then we put Chili's under "Purchase," "Eating Out" under "Category," and "$20" under "amount spent."This way if there is a discrepancy in how much we have spent in "Total to Date," we can look at our "Detailed Account Spending" to make sure everything matches up. You aren't budgeting if you aren't tracking every penny you spend. And if you don't tell your money where to go, it just goes.I added a couple of examples so you can see how it works. Notice how there are two instances of "Eating Out," and the "Total to Date" reflects both of those purchases. You can also see how the phone bill is a fixed number.The truth is, having a budget means having to say no to certain things, and that isn't always fun. But not having to worry when you have car trouble, or having the savings to go on a vacation is more than worth the trouble.All of this, goes back to what Jesus said in Matthew 6:24.

No one can serve two masters, for either he will hate the one and love the other, or he will be devoted to the one and despise the other. You cannot serve God and money.

Have any questions about this post? Click here to connect with me on Facebook and let's chat!